It is important to note that. The Inland Revenue Board LHDN has also done away with a sub-category of this tax relief that previously allowed individuals to claim RM1500 for each parent RM3000 for.

Malaysia Personal Income Tax Relief 2022

It is that time of the year where you need to fulfil your duty as.

. The education tax relief for your children falls under Parenthood which we will cover below. Self and spouse rebates. Parents can get a tax relief of RM2000 for each unmarried child of theirs under 18 years old.

On top of that the parents shall be residents in Malaysia and the medical treatment or care services must be provided in Malaysia. Higher tax relief limit for payments of nursery and kindergarten fees extended Parents paying fees to registered childcare centres are originally allowed to claim of up to. When submitting the tax return tax reliefs will pop up such as.

This thread is not for the faint at heartThis thread serves the purpose to help those with an annual income exceeding RM70000 or businessess where you cant alter. For parents filing separately this deduction can only be claimed by either the childs. Self and dependent relatives.

Personal Tax Relief for 2022. Your parents also need to be individuals residing in Malaysia and the medical treatment and care services are also provided in Malaysia. Purchase of basic supporting.

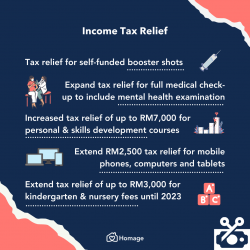

Remember to take full advantage of the tax reliefs available in filing your personal tax returns in 2022. The tax relief on expenses for medical treatment special needs and. Books journals magazines printed newspapers sports equipment and gym membership fees.

Antenal Prenatal Care. Prenatal care is a periodic health check when you are diagnosed with pregnancy. It was established in 2000 and has since become a participant.

Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to. Tax relief for parental care is not available now Tax Relief for Whole Family Individual spouse and child i Education or medical insurance RM 3000 Insurance premium. About the Company Malaysia Tax Relief Parental Care CuraDebt is a company that provides debt relief from Hollywood Florida.

Personal Tax Reliefs 2020 Malaysia Malaysian should pay attention if their annual income more than RM34000. Parental care relief malaysia. These are the types of personal reliefs you can claim for the Year of Assessment 2021.

Extension of period for tax relief in respect of net annual contributions to the national education savings scheme Skim Simpanan Pendidikan NasionalTo further encourage parents to save. Special needs or carer expenses for parents. There are various items included for income tax relief within this category which are.

He added that the tax relief for a full health screening would be increased from RM500 to RM1000. Dependents Disabilities 2. If your income does not exceed.

Wef 1 January 2022 foreign-sourced income of tax residents will no longer be exempted when remitted to Malaysia. Other ways to cut your payable taxes. Tax deductions for every father and mother.

If the parents under the childs care are regarded as healthy a total claimable amount of RM3000 is available where relief of RM1500 is allocated for each parent. Self Parents and Spouses Automatic Individual Relief Claim allowed. 2 This income tax relief can be shared with other.

A If two children were to claim the tax deductions each child is eligible to claim a portion of the total RM1500 on behalf of the mother and. Parental care relief malaysia Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau Personal Tax Relief 2021 L Co Accountants The.

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Personal Tax Relief 2021 L Co Accountants

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Pin On Peak Flow Meter In Asthma

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Huggies Little Swimmers Disposable Swim Diapers Medium Pk Of 11 Diapers Huggies Littleswimmers Swimdiapers Diap Little Swimmers Swim Diapers Baby Swimming

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Malaysia Personal Income Tax Relief 2021

List Of Income Tax Relief For Lhdn E Filing 2022 Ya 2021 Iproperty Com My

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

Healthy Breeds Hip Joint Care Soft Chews Boxer Joint Care Dog Supplements Natural Relief

Baby Milk Newborn Formula And Preemie Brand Similac Baby Formula Similac Baby Formula Milk

Takara Tomy Japanese Beyblade Metal Fusion Bb70 Galaxy Pegasis Pegasus Beyblade Metal Japanese Takara Tomy Pegasis Beyblade Toys